Discover Wyoming Credit Unions: Comprehensive Financial Providers Near You

Discover Wyoming Credit Unions: Comprehensive Financial Providers Near You

Blog Article

Why You Should Choose Lending Institution for Financial Stability

Credit history unions stand as columns of financial stability for several individuals and communities, providing an unique method to financial that prioritizes their participants' well-being. There's more to debt unions than just monetary advantages; they likewise cultivate a feeling of neighborhood and empowerment amongst their members.

Reduced Fees and Competitive Rates

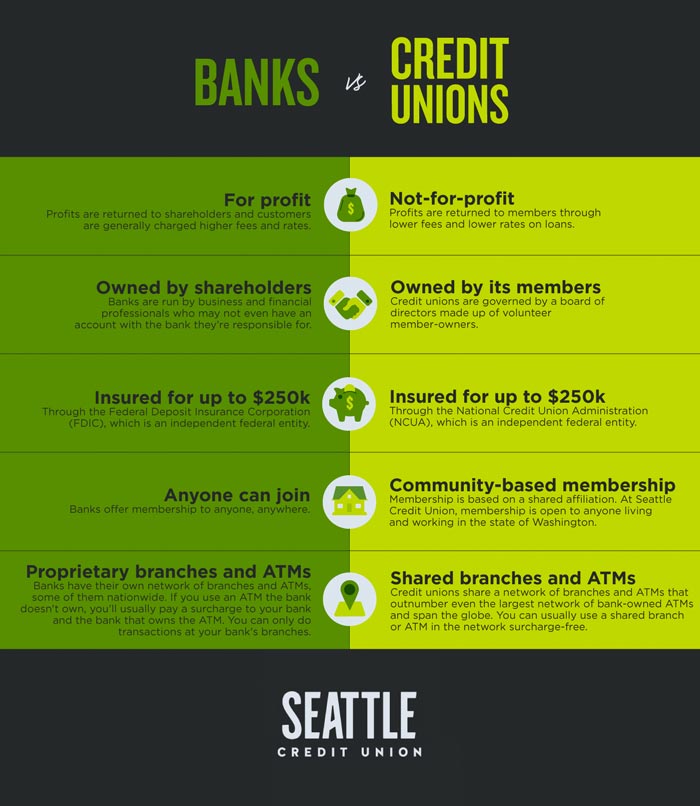

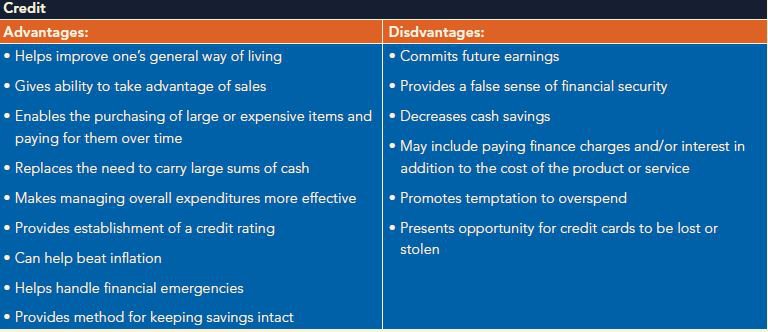

Credit scores unions commonly offer lower charges and competitive prices contrasted to typical financial institutions, supplying consumers with a much more solvent option for managing their financial resources. One of the crucial benefits of cooperative credit union is their not-for-profit structure, enabling them to focus on member benefits over optimizing earnings. This distinction in emphasis makes it possible for cooperative credit union to supply reduced costs for solutions such as examining accounts, interest-bearing accounts, and finances. Credit Unions Cheyenne. Additionally, cooperative credit union usually offer much more competitive interest prices on interest-bearing accounts and financings, converting to much better returns for members and lower borrowing costs.

Personalized Customer Care

Supplying tailored aid and personalized solutions, cooperative credit union focus on customized client service to satisfy members' particular monetary requirements efficiently. Unlike standard financial institutions, cooperative credit union are understood for growing an extra personal partnership with their members. This tailored strategy includes comprehending each member's special economic scenario, goals, and preferences. Credit report union personnel often take the time to listen attentively to participants' worries and offer customized recommendations based upon their specific requirements.

Additionally, lending institution frequently go the extra mile to guarantee that their members feel valued and supported. By building strong relationships and promoting a sense of community, cooperative credit union produce a welcoming atmosphere where members can trust that their financial health remains in great hands.

Strong Neighborhood Focus

With a commitment to sustaining and promoting regional connections area campaigns, credit unions focus on a strong community emphasis in their procedures. Unlike conventional banks, lending institution are member-owned financial establishments that run for the benefit of their members and the areas they serve. This distinct structure permits cooperative credit union to concentrate on the wellness of their participants and the regional community instead of exclusively on generating earnings for outside shareholders.

Cooperative credit union often participate in numerous neighborhood outreach programs, sponsor regional events, and team up with other companies to attend to community requirements. By investing in the neighborhood, cooperative credit union assist boost regional economic situations, produce work chances, and boost overall top quality of life for locals. In addition, credit history unions are understood for their participation in monetary proficiency programs, offering academic resources and workshops to help area participants make informed monetary choices.

Through their strong community emphasis, credit scores unions not just provide monetary solutions yet also function as columns Wyoming Credit Unions of support and stability for the communities they offer.

Financial Education and Aid

In advertising economic proficiency and supplying assistance to individuals in requirement, debt unions play a crucial duty in encouraging areas in the direction of economic stability. One of the key advantages of debt unions is their emphasis on supplying monetary education to their members.

Furthermore, cooperative credit union usually give assistance to members facing financial troubles. Whether it's via low-interest finances, versatile repayment strategies, or monetary counseling, cooperative credit union are devoted to assisting their members get over challenges and attain monetary security. This customized approach sets cooperative credit union in addition to traditional banks, as they prioritize the economic wellness of their participants most of all else.

Member-Driven Decision Making

Cooperative credit union encourage their members by permitting them to actively take part in decision-making processes, a practice called member-driven decision production. This method establishes cooperative credit union aside from typical banks, where choices are often made by a choose team of execs. Member-driven choice making makes sure that the passions and needs of the participants continue to be at the forefront of the debt union's operations.

Eventually, member-driven decision making not only boosts the total member experience but also advertises openness, count on, and accountability within the credit scores union. It showcases the cooperative nature of credit unions and their dedication to serving the best passions of their participants.

Conclusion

Finally, lending institution supply a compelling option for economic stability. With reduced costs, affordable rates, personalized customer support, a solid area focus, and a dedication to economic education and aid, credit report unions focus on member benefits and empowerment. With member-driven decision-making procedures, lending institution advertise openness and responsibility, making certain a secure financial future for their members.

Debt unions stand as pillars of financial stability for lots of people and areas, using an one-of-a-kind strategy to financial that prioritizes their participants' health. Unlike typical financial institutions, credit scores unions are member-owned financial institutions that run for the benefit of their participants and the neighborhoods they serve. Credit Unions Cheyenne WY. Furthermore, credit history unions are recognized for their participation in monetary literacy programs, supplying academic resources and workshops to help neighborhood members make informed economic choices

Whether it's through low-interest car loans, versatile repayment plans, or monetary counseling, credit history unions are committed to helping their members get rid of challenges and accomplish financial security. With reduced fees, competitive prices, individualized customer solution, a solid neighborhood emphasis, and a commitment to financial education and aid, credit rating unions focus on member benefits and empowerment.

Report this page